UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material under § 240.14a-12

AKOUSTIS TECHNOLOGIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b)

per Exchange Act Rules 14a- 6(i)(1) and 0-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 14, 2024

AKOUSTIS

TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or Other Jurisdiction

of Incorporation) |

001-38029

(Commission File

Number) |

33-1229046

(I.R.S. Employer

Identification Number) |

9805 Northcross Center Court, Suite A

Huntersville, NC 28078

(Address of principal executive offices, including

zip code)

704-997-5735

(Registrant’s telephone number, including area

code)

Not Applicable

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

o Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: |

|

Trading Symbol: |

|

Name of each exchange on which registered: |

| Common Stock, $0.001 par value |

|

AKTS |

|

The Nasdaq Stock Market LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.b-2 of this chapter)

Emerging Growth Company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

As previously disclosed, on August 19, 2024, Akoustis Technologies, Inc.

(the “Company”) received a notice from the Staff of the Nasdaq Listing Qualifications Department (the “Staff”)

indicating that the bid price for the Company’s common stock had closed at $0.10 or less per share for the 10-consecutive trading

day period ended August 16, 2024. As a result, and in accordance with Nasdaq Listing Rule 5810(c)(3)(A)(iii), the Staff determined to

delist the Company’s common stock from The Nasdaq Capital Market (the “Delisting Determination”). Additionally, as previously

disclosed, on October 10, 2024, the Company received a written notice from the Staff indicating that the Company was not in compliance

with Nasdaq Listing Rule 5550(b)(1), which requires companies listed on The Nasdaq Capital Market to maintain a minimum of $2,500,000

in stockholders’ equity for continued listing (the “Stockholders’ Equity Requirement”), based on the Company’s

stockholders’ deficit as of June 30, 2024 reported in its Annual Report on Form 10-K filed with the Securities and Exchange Commission

on October 8, 2024. The Company appealed the Delisting Determination and, on October 8, 2024, presented its compliance plans in respect

of the $1.00 minimum bid price requirement under Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Requirement”) and

the Stockholders’ Equity Requirement at a hearing (the “Hearing”) before the Nasdaq Hearings Panel (the “Panel”).

On October 14, 2024, the Company received a decision

from the Panel granting its request for continued listing on The Nasdaq Capital Market, subject to the following conditions:

| · | On or before December 17, 2024, the Company must demonstrate compliance with the Minimum Bid Price Requirement;

and |

| · | On or before January 31, 2025, the Company shall provide the Panel an update regarding its efforts to

regain compliance with the Stockholders’ Equity Requirement. |

The Company is monitoring the closing bid price of its common stock and

will consider options to regain compliance with the Minimum Bid Price Requirement, including holding the previously announced annual meeting of

stockholders on November 21, 2024 (the “Annual Meeting”), at which Annual Meeting the Company will seek stockholder approval

for the implementation of a reverse stock split of the Company’s common stock at a ratio between 1-for-50 and 1-for-250,

inclusive, with the ultimate ratio to be determined by the Company’s board of directors in its sole discretion. However, there can

be no assurance that the Company will timely regain compliance with the Minimum Bid Price Requirement or the Stockholders’ Equity

Requirement.

Forward-Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements

within the meaning of federal securities laws with respect to the Company. Forward-looking statements are predictions, projections, and

other statements about future events based on current expectations and assumptions and, as a result, are subject to risks and uncertainties.

Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including

but not limited to: the Company’s ability to obtain stockholder approval at the Annual Meeting to effect a reverse stock split;

the Company’s ability to cure its deficiency in compliance with the Bid Price Requirement; the Company’s ability to present

to the Panel a satisfactory update regarding its efforts to regain compliance with the Stockholders’ Equity Requirement and ultimately

regain compliance with the Stockholders’ Equity Requirement; the Company’s ability to otherwise maintain compliance with other

Nasdaq Listing Rules during the compliance period granted by the Panel; and risks related to the substantial costs and diversion of personnel’s

attention and resources due to these matters. A delisting of the Company’s common stock from Nasdaq would materially and adversely

affect its ability to raise capital and our financial condition and business. Forward-looking statements speak only as of the date they

are made. Readers are cautioned not to put undue reliance on forward-looking statements, and, except as required by law, the Company assumes

no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future

events, or otherwise.

Additional Information and Where to Find It

This document may be deemed to be solicitation material in respect of the

Annual Meeting to be held on November 21, 2024. The Company previously filed a definitive proxy statement with the United States Securities

and Exchange Commission (the “SEC”) on October 8, 2024. BEFORE MAKING ANY VOTING DECISIONS, SECURITY HOLDERS ARE URGED TO

READ THE DEFINITIVE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT

THE ADJOURNED MEETING. The definitive proxy statement has been mailed to stockholders who are entitled to vote at the Annual Meeting.

No changes have been made in the proposals to be voted on by stockholders at the Annual Meeting. The Company’s proxy statement and

any other materials filed by the Company with the SEC can be obtained free of charge at the SEC’s website at https://www.sec.gov/.

Participants in the Solicitation

The Company and its directors and executive officers and other employees

may be deemed to be participants in the solicitation of proxies in respect of the Annual Meeting.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Akoustis Technologies,

Inc. |

| |

|

| Date: October 15, 2024 |

By: |

/s/ Kenneth E. Boller |

| |

Name: |

Kenneth E. Boller |

| |

Title: |

Chief Financial Officer |

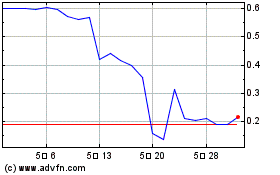

Akoustis Technologies (NASDAQ:AKTS)

과거 데이터 주식 차트

부터 10월(10) 2024 으로 11월(11) 2024

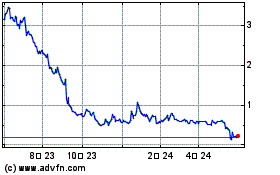

Akoustis Technologies (NASDAQ:AKTS)

과거 데이터 주식 차트

부터 11월(11) 2023 으로 11월(11) 2024