Antipodean Currencies Fall Amid Risk Aversion

06 12월 2024 - 11:12AM

RTTF2

Antipodean currencies such as the Australia and the New Zealand

dollars weakened against their major currencies in the Asian

session on Friday amid risk aversion, as traders remain cautious

and are reluctant to make significant moves ahead of the release of

the closely watched monthly U.S. jobs data later in the day that

will offer clues on the U.S. Fed's interest rate moves. Political

turmoil in South Korea and France also weighed on the investor

sentiment.

The U.S. jobs data could impact the outlook for interest rates

ahead of the Federal Reserve's next monetary policy meeting later

this month.

While traders have recently expressed greater confidence the Fed

will lower rates by another 25 basis points at the December

meeting, there remains uncertainty about the likelihood of

continued rate cuts at future meetings.

In France, President Emmanuel Macron said he will name a new

Prime Minister "in the coming days" to prevent the country from

sliding deeper into political turmoil.

Elsewhere in South Korea, President Yoon Suk Yeol faces

impeachment vote as early as Saturday tor trying to impose martial

law.

Investors are also looking at the possibility of further

reductions in the reserve requirement ratio by the Chinese central

bank this month.

Crude oil prices dipped, weighed by weak demand from China and

rising production in the United States - although the downside was

limited by OPEC's decision to delay a production increase. West

Texas Intermediate Crude oil futures for January fell $0.24 or 0.4

percent at $68.30 a barrel.

In the Asian trading, the Australian dollar fell to 2-day lows

of 0.6420 against the U.S. dollar and 96.30 against the yen, from

yesterday's closing quotes of 0.6450 and 96.80, respectively. If

the aussie extends its downtrend, it is likely to find support

around 0.61 against the greenback and 94.00 against the yen.

The aussie slid to a 1-month low of 1.6461 against the euro,

from Thursday's closing value of 1.6400. On the downside, 1.66 is

seen as the next support level for the aussie.

Against the Canada and the New Zealand dollars, the aussie

slipped to a 2-day low of 0.9014 and more than a 1-month low of

1.0948 from yesterday's closing quotes of 0.9044 and 1.0958,

respectively. The next possible downside target for the aussie is

seen around 0.89 against the loonie and 1.08 against the kiwi.

The NZ dollar fell to nearly a 3-week low of 1.8057 against the

euro and a 2-day low of 87.79 against the yen, from yesterday's

closing quotes of 1.7985 and 88.31, respectively. If the kiwi

extends its downtrend, it is likely to find support around 1.82

against the euro and 87.00 against the yen.

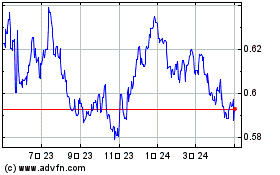

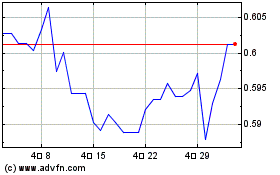

Against the U.S. dollar, the kiwi edged down to 0.5855 from

Thursday's closing value of 0.5884. The kiwi may test support near

the 0.56 region.

Looking ahead, Eurostat releases euro area revised GDP data for

the third quarter at 5:00 am ET in the European session. The

initial estimate showed that the currency bloc expanded 0.4 percent

sequentially.

In the New York session, U.S. and Canada jobs data for November,

Canada Ivey PMI for November, U.S. University of Michigan consumer

sentiment index for December and U.S. Baker Hughes oil rig count

data are slated for release.

NZD vs US Dollar (FX:NZDUSD)

외환 차트

부터 11월(11) 2024 으로 12월(12) 2024

NZD vs US Dollar (FX:NZDUSD)

외환 차트

부터 12월(12) 2023 으로 12월(12) 2024